CORPORATE

The Writing On The Wall

Will Ramalinga Raju be India’s first CEO to be forced out?

VENKATESH GANESH

02 Jan 2009

There is a story that Ramalinga Raju’s grandfather — an enterprising farmer — ventured out of traditional agriculture and bought a sugar mill. The venture backfired, and the family lost a fortune. Flash forward to 16 December 2008: Raju announced a similar switch — 20-year-old Satyam Computer Services (Satyam) would ‘diversify’ into the realty business by acquiring two Raju family-run firms — listed Maytas Infrastructure and unlisted Maytas Properties.

This time around, institutional investors expressed outrage, forcing Raju to withdraw the proposal; industry watchers, analysts, commentators and management consultants called it a way to siphon off cash from Satyam’s books to meet the debt repayment and cash obligations that the two Maytas firms had to meet. Raju’s sons run the two firms and the family owns nearly 36 per cent of Maytas Infrastructure and 35 per cent in Maytas Properties.

Shaky Confidence

Raju’s hasty announcement — without a board approval — and an equally quick retraction could make him the first forcibly removed CEO in India. “There is great likelihood of a management change when the Satyam board convenes on 10 January and Raju will be asked to step down,” says Khozema Anajwalla, partner of accounting at Inde Global. Brokerage firms who slammed the stock, following the 16 December announcement, also feel that a change in the top management should be something that the board needs to look at urgently.

“Satyam has 61 per cent institutional holding who would be looking to either reduce their stake or engineer a deal that would ensure changes at the top,” says Nishant Verma, vice-president of Bangalore-based Tholons Capital. It is learnt that institutions are gathering support to push for a new CEO in the upcoming board meeting. “There is a lot of talk amongst institutions to vote for a new management in the light of even problems arising out of bribery in outsourcing contracts,” says an Indian fund manager who manages some Satyam portfolios.

Raju postponed the board meeting by a fortnight and is mustering support to retain management control. A website, www.ramalingaraju.com, run by one of Raju’s nephews, extols Raju’s virtues as an entrepreneur. It rubbishes media reports as giving a “completely different and untrue image about a soft, humble and good-natured individual”.

Satyam’s investor relations team is believed to be calling up broking houses and research analysts to explain their position and seek support. “Satyam did not — and does not now — intend to retreat from IT and BPO services in any way, and going forward, Satyam will focus extensively on these markets,” Raju says in an e-mail to Satyam employees.

Clearly, there is confusion. “This is a U-turn from their earlier stance that diversification into other businesses such as realty was the way forward,” says Anajwalla. Peter Schumacher, CEO of Value Consulting [Correction: Should read – Value Leadership Group], agrees: “This raises doubts in the customers’ mind about the management’s motives and commitment to the business.”

The noises made by Raju may not have assuaged employees’ uncertainty, but they seemed to have been enough for Aberdeen Asset Management, the largest institutional investor with 6.6 per cent stake. On 17 December, Adrian Lim, fund manager at Singapore-based Aberdeen, had called the acquisition announcement “shocking”, adding that his firm would not tolerate a change in Satyam’s core business. On 30 December, he said: “They need to work hard and quickly to rebuild their reputation.”

But Aberdeen has been buying Satyam shares since the botched acquisition proposal was called off. It acquired 305,000 shares, or 0.095 per cent, on 17 December, and another 320,000 shares — 0.1 per cent —on 20 December.

Time For Change?

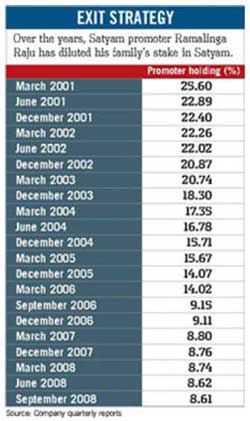

There are credible reports that the Raju family now owns just about 5 per cent of the stock. This is down from 8.61 per cent after institutions it had borrowed from, sold shares pledged with them. That makes Raju a professional manager rather than a promoter-owner; his performance could be assessed accordingly. So, murmurs of a possible change in management are beginning to grow louder.

One thing seems certain: that a change at the helm will be on the agenda when the board meets in the plush 2,000 sq. ft hall at Satyam’s Hyderabad headquarters on 10 January. Raju could be asked to step down from the company that he nurtured from its infancy till it became a $2.14-billion firm. Could this indeed be the first instance of a forced management change, in India’s corporate history? |

|

|

|

With inputs from Dhanya Krishnakumar

Download PDF version of the Article.

venkatesh.ganesh@abp.in

(Businessworld Issue 06-12 Jan 2009)

An ABP Pvt Ltd Publication Copyright (C) All rights reserved. |