INFORMATION TECHNOLOGY

Spreading Their Wings

Infosys’s acquisition of the Axon group has got mixed reviews

DHANYA KRISHNAKUMAR

29 Aug 2008

Peter Schumacher comments on Infosys’ intention to acquire Axon Global, a UK-based IT services firms that specializes in SAP services

HAPPY HOUR: (From left) Infosys Technologies Chief Operating Officer S.D. Shibulal, Chairman N.R. Narayana Murthy and Chief Executive Officer Kris Gopalakrishnan after

announcing the Axon acquisition (AP)

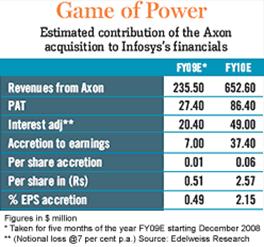

After being hounded by the markets for the past three years for sitting on $2 billion (Rs 8,600 crore) of cash, Infosys Technologies has finally opened its treasure chest. It has acquired a 100 per cent stake, for $753 million (in Rs 3,291 crore), in Axon Group, a UK-based company that specialises in consultation and implementation of SAP enterprise software and earned a net profit of $37.4 million last year on revenue of $378.3 million. This is by far the largest overseas acquisition by Indian IT company, surpassing Wipro Technologies’ Rs 2,400-crore acquisition of US-based InfoCrossing last year. Nasdaq-listed Infosys expects to complete the deal, after necessary shareholder and regulatory approvals by November.

While on one hand the acquisition will silence detractors who have criticised the company for sitting on hefty cash reserves, on the other, it will help Infosys bolster its consulting business, which has been struggling to break even. The deal provides Infosys a ready access to the existing market of Axon in Europe by leveraging its current capabilities and brand presence in Europe. Also, Axon provides Infosys an edge when it comes to high-end consulting. Infosys can leverage its size and global presence along with Axon’s consulting expertise to win big transformational deals in the US, and Europe. “Our rationale was that with this acquisition, our global reach, scale and our ability to participate in large transformational deals would be significantly enhanced,” says Infosys CEO Kris Gopalakrishnan. “The strategic combination of our groups will accelerate the realisa-tion of our common aspiration — that of becoming the most respected provider of business transformational services in the global marketplace, he says.”

Opinions Galore

But some market analysts feel that Infosys has overpaid for a company that is into specific IT consulting, especially at a time when outsourcing orders from Europe are hard to come by.

According to a note released by Mumbai-based research firm Edelweiss, Infosys overpaid for the acquisition, considering that Axon derives 20 per cent of its revenues from pure-play consulting and the rest from implementing SAP systems.

“We believe that it will have to work hard at bringing up margins in Axon to Infosys’s average and this may well take at least three-four years,” says the note. Apurva Shah, IT analyst of Prabhudas Leeladhar agrees. “It would be challenging for Infosys to extract synergies from the deal much in excess of the premium paid, given the tough operating macro environment and Axon’s dependence on SAP.” However, Infosys has publicly stated that projects of Axon won’t overlap with its own. Despite this, several analysts are of the opinion that the deal is expensive in the near term.

But there are other analysts who predict a brighter outlook. According to research firm Forrester, the deal is neither too small to be inconsequential, nor mammoth enough to be impossible to manage. Rajesh Jain, head of ICE, KPMG, says, “compared to higher end peer valuations, this is not over-priced.” Forrester believes that the deal will not fall apart at least on the ground of high-leveraged and client-connected staff leaving. “While Infosys has no experience of managing such a large acquisition and integrating two diverse culture firms, given that the current Axon management is committed to stay for a period over two years, there is a good possibility of reasonably smooth integration,” says Sudin Apte, a senior analyst with Forrester Research.

KPMG’s Jain also points out that, “Most (Indian) companies have been eyeing acquisitions and Europe is an integral part of that strategy.” This is because the growth rate of MNCs this year (over last year’s) has been better than the Indian IT firms and consulting or business domain experience and global footprint are the two major factors that are defining leadership. Indian firms are left with no choice but to take the acquisition route to growth. According to Tholons, a Bangalore-based IT firm, which advises firms with more than $5 billion in revenues (Tier-1), smaller acquisitions have hardly made any impact in terms of capabilities or synergies. A meaningful acquisition, according to them, needs to be in the $500 million to $2 billion range. KPMG’s Jain also points out that, “Most (Indian) companies have been eyeing acquisitions and Europe is an integral part of that strategy.” This is because the growth rate of MNCs this year (over last year’s) has been better than the Indian IT firms and consulting or business domain experience and global footprint are the two major factors that are defining leadership. Indian firms are left with no choice but to take the acquisition route to growth. According to Tholons, a Bangalore-based IT firm, which advises firms with more than $5 billion in revenues (Tier-1), smaller acquisitions have hardly made any impact in terms of capabilities or synergies. A meaningful acquisition, according to them, needs to be in the $500 million to $2 billion range.

A Question Of Timing

The timing of the acquisition is also attracting attention. “Why acquire Axon now?” asks Peter Schumacher, CEO of Value Leadership, a US- based IT consulting company. “With the world economy softening, the IT services sector in Europe is expected to slow and valuations decline further. Did Infosys become impatient and pay too much?” A look at the size of outsourcing deals from European companies makes his question a valid one. This year not a single outsourcing deal in the range of $100 million or upwards has gone to the country’s top three IT majors, including Infosys. Majority of the deals have been in the $5million-10 million range, leading one to conclude that there are no big ticket deals at present in Europe.

However, Indian IT majors who have traditionally been getting about 70 per cent of their revenues from US are slowly gaining foothold in Europe, albeit with small deals. “Given that over 60 per cent of Axon’s revenues are derived from Europe, we expect Infosys’s consolidated revenues from Europe to move from the current 28 per cent to 28.6 per cent and 30.4 per cent in FY 09 and FY 10,” says Shah of Prabhudas Leeladhar.

Europe is an attractive growth market but one that Indian firms have found hard to break into. And the Infosys-Axon deal meets most of the strategic intent that Indian firms need to pursue. Says Avinash Vashishtha, CEO of Tholons, “Axon plugs a significant gap in Infosys’ geography diversification and presence in a high-growth market.” Adds Forrester’s Apte, “The deal brings, we estimate, over a hundred new clients and missing industry verticals such as public sector to Infosys’s fold.” He adds that despite Axon’s substantial employee base in Europe, it is Infosys that is better equipped to address the much-wanted European client demand of a “combination of local Europe presence and offshore scale”. According to Manoj Mohta, Head of Crisil Research, “When an Indian Tier-1 player makes an acquisition in the European market, which in turn leads to part of the work being offshored to India, it can lead to a 4-6 per cent improvement in margins through that acquisition over 3-4 years.” If Infosys could capitalise on this, its margins — which are already better than most domestic IT majors, should see an uptick.

With Inputs from Venkatesh G. in Mumbai

'dhanya(dot)krishnakumar(at)abp(dot)in'

(Businessworld Issue 2-8 Sep 2008)

Download the Article in PDF Format.

An ABP Pvt Ltd Publication Copyright © All rights reserved.

|